Folks, how are you doing?

I hope that you all have a great time with y'all family.

Family is one of the motivation I have in this market pursuit.

I'm a Process Engineer in a Plastics Compounding Factory. Engineer, sounds great ain't it?

Well, it does not work as good as it is sound. But i like my career here.

I'm a Chemical Engineering, minor in Polymer graduate. Polymer? what is that? Well, in short, Plastics. haha.

--------------------------------------------------------------------------------------------------------------------

Previously we talked about the Gartley Pattern formed within our entries. below are the XABCD pattern formed.

Let's have a look at smaller time frame.

A Doji Pinbar!!

not just that, a Bullish Engulfing Pattern,

Gentlemen, this can be considered a very good confluence, plus the pattern is appear around the support level @ 1.1870.

So, as usual, Entry!!!

Our Stop Loss this time is the X level, around 1.17730 ;

Our Take Profit target would be around 1.21840.

Seat back and relax, and enjoy the view.

----------------------------------------------------------------------------------------------------------------------

There are no 100% Guaranteed technique in the world.

The entry trade i made above might works, or it could even might not success.

These all are a learning process.

We've done the best we could.

But we are not the market mover.

Cheers.

Shares thought of market movement, directions, sentiments, through technical analysis. Discuss candle pattern appears in market and how to act.

Friday, 15 September 2017

Wednesday, 13 September 2017

EUR/USD 2017.09.11 [ SL or TP ]

Fellas!!!

So this is the result from previous post. My Take Profit actually is around 61.8 - 78.6 % of retracement XA. it is acceptable, and im just gonna be flexible about it.

As you can see, the profit is 120 pips and took me around 2 - 3 days to complete the order.

As you can see, the D is formed when the price reaches the area of 78.6% XA.

Thus, our Gartley Pattern is complete, and we actually can place the order for Long position in that area.

Cheers.

Monday, 11 September 2017

EUR/USD 2017.09.11 [ Analysis ]

Folks..

Remember the last post we talked about that? you know..that..

i dont know. haha.

So basically last post was the review of entry order i made based on break resistance level.

and i touch a little bit about the Gartley Pattern.

As mentioned in previous post, i am actually waiting for a Gartley Pattern to show up. and right now, the pattern has left only 1 point to complete, point D.

Remember this picture?

XABC-D.

The point C has reached. And....look at that candle pattern.

What pattern is that?

A Doji Pinbar. it showed very strong rejection from the sellers.

Would it be a very good chance to make entry there? YES..YES..YES INDEED!

How are we going to make it?

Just place the order fellas!! with Stop loss and Take profit. never forget about these 2 most important part in every trade you make.

--------------------------------------------------------------------------------------------------------

Trading by youself is about Capital Preservation.

This is a game where you need to learn.....NOT how to make money, BUT.

HOW TO NOT LOSS MONEY...

Which is why, the STOP LOSS is very very important.

--------------------------------------------------------------------------------------------------------

We will make an order entry after the candle closes.

The STOP LOSS would be a little higher of Doji Pinbar high.

and the TAKE PROFIT?

Remember what i said? im looking for Gartley pattern.

The point D will falls on around 78.6% of XA.

Which is...

around 1.1840.

And that is our target of profit.

This is a Daily chart, you can refine your entry by looking at smaller time frame, look for much precise entry.

But as you can see, the sneak peak over there, the next day have a Bearish rally.

A good sign that the Gartley Pattern will be formed...

Cheers.

Remember the last post we talked about that? you know..that..

i dont know. haha.

So basically last post was the review of entry order i made based on break resistance level.

and i touch a little bit about the Gartley Pattern.

As mentioned in previous post, i am actually waiting for a Gartley Pattern to show up. and right now, the pattern has left only 1 point to complete, point D.

Remember this picture?

XABC-D.

The point C has reached. And....look at that candle pattern.

What pattern is that?

A Doji Pinbar. it showed very strong rejection from the sellers.

Would it be a very good chance to make entry there? YES..YES..YES INDEED!

How are we going to make it?

Just place the order fellas!! with Stop loss and Take profit. never forget about these 2 most important part in every trade you make.

--------------------------------------------------------------------------------------------------------

Trading by youself is about Capital Preservation.

This is a game where you need to learn.....NOT how to make money, BUT.

HOW TO NOT LOSS MONEY...

Which is why, the STOP LOSS is very very important.

--------------------------------------------------------------------------------------------------------

We will make an order entry after the candle closes.

The STOP LOSS would be a little higher of Doji Pinbar high.

and the TAKE PROFIT?

Remember what i said? im looking for Gartley pattern.

The point D will falls on around 78.6% of XA.

Which is...

around 1.1840.

And that is our target of profit.

This is a Daily chart, you can refine your entry by looking at smaller time frame, look for much precise entry.

But as you can see, the sneak peak over there, the next day have a Bearish rally.

A good sign that the Gartley Pattern will be formed...

Cheers.

Friday, 8 September 2017

EUR/USD 2017.09.06 [Stop Loss-ED or Take Profit-ED]

The previous post is about taking Long position in pair EUR/USD at the Bullish Pinbar.

So, does my entry hits Take profit?

Or Stop loss-ED?

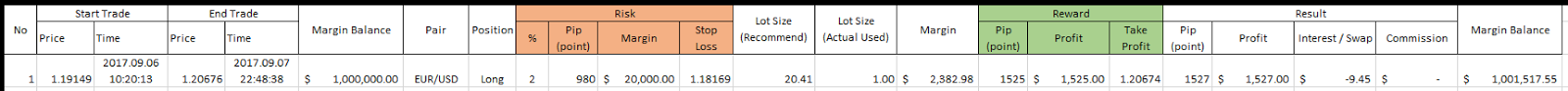

Ok, by the way, I am now practice-ing making my own trading order journal.

In Traders Inxighter Blog, i will try my best to make this place a trading journal. Talks about the plan, the analysis, the estimation.

and also, i have an excel file that i will key in all the order i made.

There you go,

So i have,

1. The usual, No. of Trade, Start trade and End trade time.

2. My initial Capital, by the way this is a Practice Account. [haha]

3. The pair i will make the entry and is it Long or Short Position.

4. Important Part : Risk and Reward (Red and Green coloured]

5. Contract size and actual contract size.

6. Margin based on actual contract size.

7. Also Important Part : The Result, how much you made, how many pips you earned.

8. Balance Capital after the trade.

By the way, if you wanna scroll beside-ward. Press and hold the "SHIFT' key, and scroll you mouse.

---------------------------------------------------

Continue,

Well, i think you all already have a guess on the entry i made previously.

it's shown in the above picture.

YUP, it's a Take Profit-ED!

The excitement is not as big as when you actually made it in Real account though.

But look at the pips the entry earned. 150pips. hehe...

Continuation of the Gartley Pattern,

now the point C is made.

What is the next move?

Cheers.

So, does my entry hits Take profit?

Or Stop loss-ED?

Ok, by the way, I am now practice-ing making my own trading order journal.

In Traders Inxighter Blog, i will try my best to make this place a trading journal. Talks about the plan, the analysis, the estimation.

and also, i have an excel file that i will key in all the order i made.

There you go,

So i have,

1. The usual, No. of Trade, Start trade and End trade time.

2. My initial Capital, by the way this is a Practice Account. [haha]

3. The pair i will make the entry and is it Long or Short Position.

4. Important Part : Risk and Reward (Red and Green coloured]

5. Contract size and actual contract size.

6. Margin based on actual contract size.

7. Also Important Part : The Result, how much you made, how many pips you earned.

8. Balance Capital after the trade.

By the way, if you wanna scroll beside-ward. Press and hold the "SHIFT' key, and scroll you mouse.

---------------------------------------------------

Continue,

Well, i think you all already have a guess on the entry i made previously.

it's shown in the above picture.

YUP, it's a Take Profit-ED!

The excitement is not as big as when you actually made it in Real account though.

But look at the pips the entry earned. 150pips. hehe...

Continuation of the Gartley Pattern,

now the point C is made.

What is the next move?

Cheers.

Wednesday, 6 September 2017

EUR/USD 2017.09.06

Short review on my recent entry.

Pair : Euro pound vs. US Dollar @ EUR/USD

The previous Resistant level on the left hand side has been break by the long bullish candle on 25th August.

A Doji form and creates new high / new Resistant Level.

At this point, we realize the rejection is very strong, and probability to retrace is a good chance as well.

After a few days, a Bullish Pinbar is formed after a short downward rally the next day at 26th Aug.

We can actually place an entry here, because:

Western technique : the price reaches the previous resistant level where it is now the Support level.

Eastern technique : a Bullish Pinbar formed at the Support level.

And there you go, you can place the order.

The order can be place at 50% Retracement within the Bullish Pinbar itself.

Once triggered, you are good to go.

STOP LOSS & TAKE PROFIT

My STOP LOSS will be a little bit below the low of the Bullish Pinbar, just to let it have some space and room to breathe.

The TAKE PROFIT will be my recent High, where the Resistant Level of the Doji formed.

----------------------------------------------------------------------------------------------------------

The Plan?

I am actually waiting for Gartley Pattern to show up.

As i said in my previous post, this place will be going to be my place of study, training, practice, etc.

Easy said, training place is here.

What is Gartley Pattern?

I will explain it [here], the post about Gartley Pattern.

In this entry, the 1st part XAB triangle is formed.

You can say that my target profit is actually around the next point, C.

Till next time,

Cheers.

Pair : Euro pound vs. US Dollar @ EUR/USD

The previous Resistant level on the left hand side has been break by the long bullish candle on 25th August.

A Doji form and creates new high / new Resistant Level.

At this point, we realize the rejection is very strong, and probability to retrace is a good chance as well.

After a few days, a Bullish Pinbar is formed after a short downward rally the next day at 26th Aug.

We can actually place an entry here, because:

Western technique : the price reaches the previous resistant level where it is now the Support level.

Eastern technique : a Bullish Pinbar formed at the Support level.

And there you go, you can place the order.

The order can be place at 50% Retracement within the Bullish Pinbar itself.

Once triggered, you are good to go.

STOP LOSS & TAKE PROFIT

My STOP LOSS will be a little bit below the low of the Bullish Pinbar, just to let it have some space and room to breathe.

The TAKE PROFIT will be my recent High, where the Resistant Level of the Doji formed.

----------------------------------------------------------------------------------------------------------

The Plan?

I am actually waiting for Gartley Pattern to show up.

As i said in my previous post, this place will be going to be my place of study, training, practice, etc.

Easy said, training place is here.

What is Gartley Pattern?

I will explain it [here], the post about Gartley Pattern.

In this entry, the 1st part XAB triangle is formed.

You can say that my target profit is actually around the next point, C.

Till next time,

Cheers.

Monday, 28 August 2017

The Sunrise

Hi folks.

Welcome to the Traders Insight Apprentice. My name is Nazreen. This blog was created to serve a few purposes.

1. Self-study for each section of pattern within the market.

Basically I will be using this blog as my study journal. For all the things I've learnt, I will try my best to make a note here.

The plan is to go section by section, as for currently, I'm doing the first study, Doji, or candle that have small boy with shadows.

2. Market analysis from time-to-time.

As I was mentioned above, I do self-study in here. So... why not I make some analysis based on what I learnt?

Apply the knowledge to the chart. Easy, perhaps?

3. What else? my life maybe. Haaa..

------------------------------------------------------------------------------------------------------------------------

There are a lot of technique and each works at its own way and pattern.

There are, by far, 2 types of analysis,

Welcome to the Traders Insight Apprentice. My name is Nazreen. This blog was created to serve a few purposes.

1. Self-study for each section of pattern within the market.

Basically I will be using this blog as my study journal. For all the things I've learnt, I will try my best to make a note here.

The plan is to go section by section, as for currently, I'm doing the first study, Doji, or candle that have small boy with shadows.

2. Market analysis from time-to-time.

As I was mentioned above, I do self-study in here. So... why not I make some analysis based on what I learnt?

Apply the knowledge to the chart. Easy, perhaps?

3. What else? my life maybe. Haaa..

------------------------------------------------------------------------------------------------------------------------

There are a lot of technique and each works at its own way and pattern.

There are, by far, 2 types of analysis,

- The Technical analysis; and

- The Fundamental analysis

I am, not the latter one.

But will get to there in the future, I hope. At least I'm aiming for it.

There are a lot of technique could be used as tools during your analysis. For Fundamental type, they are using historical data, economy sentimental, interest rates, and just to name a few.

Technical type uses tools that are available in the platform (or Meta Trader). There are a lot of choices from lines, to Fibonacci, to indicators such as Moving Average, Bollinger Bands, Volumes, Fractals, and just to name a few.

However I will be not focusing on all. I'm more to a basic person, from basic, I learnt to how to use it properly, correctly, effectively, on the market chart, and make my analysis out of it.

---------------------------------------------------------------------------------------------------------------

So are you guys ready?

Cheers,

NN

Subscribe to:

Posts (Atom)